Taking the Guesswork Out of Trading #1: Synthetic ERCOT Case

- Ognjen Vukovic

- Feb 7, 2025

- 5 min read

Leveraging a fully-transparent innovative approach on the intersection of OR and ML

EnAnalytica is a specialized consultancy focused on developing advanced optimization and analysis solutions for electricity markets, particularly those employing nodal pricing mechanisms like ERCOT or flow-based market coupling like Europe. Additionally, there is also some work performed on NEMDE in Australia.

Our core research addresses the challenge of replicating and enhancing Security-Constrained Economic Dispatch (SCED) and Security-Constrained Unit Commitment (SCUC) processes using a holistic, data-driven approach combining Operations Research (OR) and Machine Learning (ML) techniques.

Research Focus and Key Questions:

Due to limitations in the availability of public data from real-world electricity markets, EnAnalytica has been developing and validating its algorithmic toolkit on a synthetic ERCOT network and other publicly available models. This testbed allows us to rigorously explore the following fundamental research questions:

Replicability of Market Clearing: Can a data-driven approach, integrating OR and ML, effectively mimic the complex security-constrained auction clearing mechanism of a nodal market within a synthetic environment?

Transferability to Real Systems: To what extent can results and insights obtained from a synthetically-driven environment be translated and applied to a realistic, operational electricity market system?

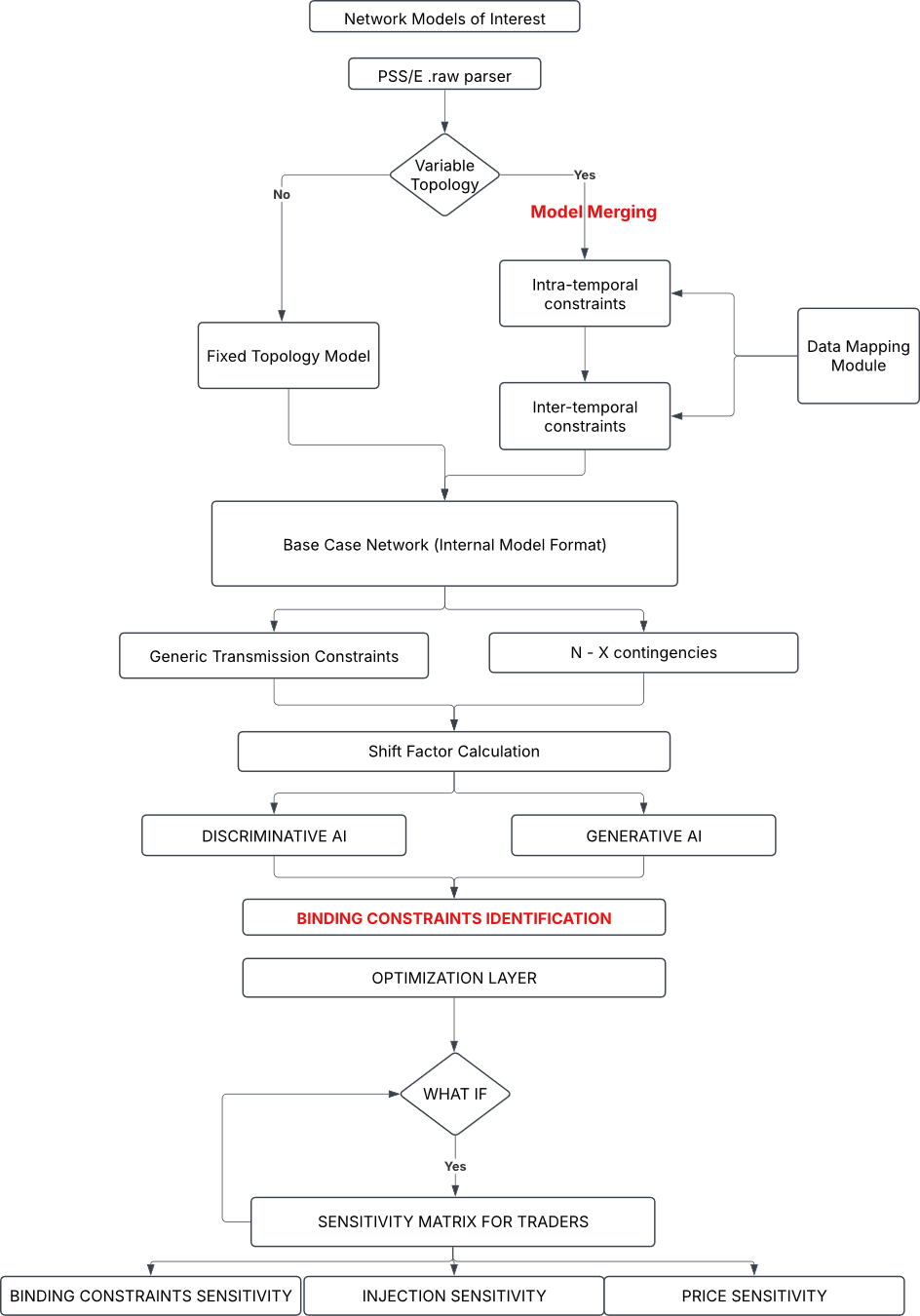

System Architecture and Capabilities:

EnAnalytica has been developing a comprehensive and modular system encompassing the following key components:

Data Modules: A robust suite of modules designed for handling power system data, including:

Data Parsers: Modules for reading and interpreting industry-standard data formats (e.g., PSS/E .raw files, CIM\CGMES).

Data Fetchers: Automated data acquisition from various sources (simulated or, potentially, real-time data feeds).

Data Analyzers: Modules for performing statistical analysis, data quality checks, and outlier detection.

Data Transformers: Modules for data cleaning, scaling, normalization, and feature engineering.

Market Module: A sophisticated simulation environment replicating the core functionalities of a nodal, zonal, regional, flow-based electricity market, including:

Medium-Term (Monthly) Market Clearing: Security-constrained optimization and market clearing for a monthly horizon.

Short-Term (Day-Ahead) Market Clearing: Security-constrained optimization and market clearing for the day-ahead market.

Real-Time Economic Dispatch: Security-constrained economic dispatch (SCED) with configurable granularity (e.g., 5-minute, 15-minute intervals according to the market design).

Inter-Module Communication: A robust interconnector facilitating seamless data exchange and coordination between the medium-term, short-term, and real-time market modules.

*There is also some work being performed on outage scheduling module, stochastic dual dynamic programming (SDDP) and stochastic dynamic programming (SDP). However, this is in initial stages of development...

Network Module: A comprehensive set of tools for power system network analysis:

Linear Analysis:

Power Transfer Distribution Factor (PTDF) calculation.

Phase Shifter Distribution Factor (PSDF) calculation.

HVDC Distribution Factor (DCDF) calculation.

Line Outage Distribution Factor (LODF) calculation

Power Flow Analysis:

DC Power Flow.

AC Power Flow (under development)

.

Contingency Analysis: Parallelized contingency analysis (N-X) for system reliability assessment.

Statistical and Machine Learning Module (Heavy Development): A cutting-edge module incorporating advanced statistical and machine learning techniques, including:

Generative AI:

Conditional Variational Autoencoder (CVAE).

Conditional Generative Adversarial Network (CGAN).

Graph Neural Network (GNN) + Generative Component.

Normalizing Flows and Autoregressive Models.

Discriminative AI and Statistical Learning: (linear regression, SVR, Random Forest, Gradient Boosting).

Modularity and Integration:

A key design principle of the EnAnalytica algorithmic toolkit is complete modularity. This enables:

Seamless Integration: The system, or individual modules, can be integrated as sub-modules within commercial power system software packages (e.g., PSS/E, PowerFactory, PLEXOS, PROMOD etc..).

Standalone Deployment: The system can operate independently as an on-premise or cloud-based solution.

Flexible Application: Individual modules can be used independently for specific tasks (e.g., using the PTDF calculator alone, or the day-ahead market clearing module). This "Lego brick" approach allows for highly customized solutions.

Key Benefits:

EnAnalytica's system offers a powerful platform for trading decision making:

Market Simulation, Analysis: Testing market rule changes, evaluating the impact of new technologies (e.g., renewable energy, storage), and training market participants.

Improved Forecasting: Enhancing the accuracy of load, generation, and price forecasts.

Operational Optimization: Optimizing generator dispatch and minimizing transmission losses in real-time.

Risk Management and Trading: Identifying and mitigating potential system vulnerabilities through advanced contingency analysis.

Research testbed: A research testbed for development and validation of OR, ML and AI algorithms.

Security Constrained Market Clearing Setup : Data-Driven Optimization and Analysis for Nodal Electricity Market Analysis

What do we exactly want to achieve:

EnAnalytica provides a powerful algorithm implementation toolkit for traders in nodal electricity markets (like ERCOT) or flow-based oriented markets (FBMC) in order to gain a competitive edge through advanced analytics and actionable insights. Our algorithmic toolkit leverages a sophisticated combination of power system modeling, optimization, and cutting-edge AI to deliver added value for traders!

Key Benefits for Traders:

Superior Price Forecasting:

Locational Marginal Price (LMP) Prediction: Our algorithmic toolkit utilizes advanced machine learning (including Discriminative and Generative AI) and detailed network modeling to generate LMP forecasts sensitivity.

Scenario Analysis ("WHAT IF"): Explore the potential price impacts of various market events, such as generator outages, transmission line outages, changes in renewable energy output, and variations in load. This allows you to anticipate market movements and adjust your trading strategies accordingly.

Probabilistic Forecasting: Understand the range of possible price outcomes, not just a single point forecast.

Optimized Bidding and Trading Strategies:

Sensitivity Analysis: Access a comprehensive sensitivity matrix that reveals:

Price Sensitivity: How LMPs at specific nodes will change in response to changes in your bids/offers.

Injection Sensitivity: How much you need to adjust your generation or load at a given location to influence prices or relieve congestion.

Binding Constraints Sensitivity: Understand how your trading activity impacts, and is impacted by, transmission constraints and congestion. This is crucial for managing congestion revenue rights (CRRs) and avoiding unexpected costs.

Optimal Bid/Offer Formulation: Use the insights from the sensitivity analysis and price forecasts to develop optimal bidding and offering strategies that maximize your profitability while managing risk.

Enhanced Risk Management:

Contingency Analysis: Assess the impact of potential outages (N-X contingencies) on LMPs and your trading positions. Our system's rapid contingency analysis, potentially accelerated by AI, allows you to proactively manage risks.

Scenario Planning: Develop robust trading strategies that account for a wide range of possible market conditions.

Improved Market Understanding:

Constraint Identification: Clearly identify the binding transmission constraints that are driving prices in the market. This allows you to understand why prices are behaving the way they are.

Data-Driven Insights: Gain a deeper understanding of the complex interactions between load, generation, transmission, and market prices.

Competitive Advantage: * Access to data and tools that the competition most likely is not using, due to the high entry costs.

Technology:

Designed with adaptability in mind, the system is not tied to specific technologies. It can be implemented using diverse programming languages and deployed on either on-premise or cloud infrastructure. The underlying algorithmic framework is highly modular.

In summary, EnAnalytica empowers traders with the information and tools they need to make more informed decisions, optimize their trading strategies, and ultimately improve their profitability in the dynamic and complex environment of nodal electricity markets. We move beyond simple forecasting to provide a deep understanding of market dynamics and sensitivities.

Comments